- #Add type of item to quickbooks for mac 2016 how to

- #Add type of item to quickbooks for mac 2016 update

- #Add type of item to quickbooks for mac 2016 full

- #Add type of item to quickbooks for mac 2016 pro

Because your company file won’t contain a full year’s worth of detail if you go this route, you might have to switch between QuickBooks and your old filing cabinets to prepare your tax returns and look up financial information. The next best start date is the last day of the previous fiscal quarter (or fiscal month, at the very least). The last day of the previous fiscal period. In cases like that, go with the next option in this list. (Intuit releases new versions of QuickBooks in October or November each year for just that reason.) But waiting isn’t always feasible. If more than half of your fiscal year has already passed, the best approach is to be patient and postpone your QuickBooks setup until the next fiscal year. And you’ll regain those hours when tax time rolls around, as you nimbly generate the reports you need to complete your tax returns. Yes, you have to enter checks, credit card charges, invoices, payments, and other transactions that have happened since the beginning of your fiscal year (see online Appendix I available from this book’s Missing CD page at but that won’t take as much time as you think. That way, the account balances on your start date are like the ending balances on a bank statement, and you’re ready to start bookkeeping fresh on the first day of the fiscal year. To do that, use the last day of your company’s previous fiscal year (or December 31, if you use the calendar year) as the company file’s start date. If your business has been running for a while, the best approach is to fill in your records for the entire current fiscal year. The last day of the previous fiscal year. If you just started your business, the start-date decision is easy: it’s the day you start your company. After that, you’ll be ready to dive into bookkeeping.

#Add type of item to quickbooks for mac 2016 how to

The rest of this chapter explains how to create a company file, and then how to open company files you create. The first time you launch QuickBooks, you’re greeted by the QuickBooks Setup dialog box, whose sole purpose is to help you create a company file in one way or another. And in Windows 8.1, you can right-click the QuickBooks desktop icon and choose “Pin to Start.”

In Windows 8, point the cursor at the screen’s upper-right corner to display the Charms menu, click Start, and then click the QuickBooks icon on the screen’s right.

#Add type of item to quickbooks for mac 2016 pro

If QuickBooks isn’t already listed in the Start menu, choose Start→All Programs→QuickBooks→QuickBooks Pro 2016 (or QuickBooks Premier 2016). In Windows 7, click Start→QuickBooks Pro 2016 (or QuickBooks Premier 2016). You can also launch QuickBooks from the Start menu. Type the label you want to use, and then press Enter. To do that, right-click the icon, and then, on the shortcut menu, choose Rename. You can rename desktop icons, as was done here. The taskbar is easy to reach, because program windows don’t hide it the way they do desktop shortcuts.

#Add type of item to quickbooks for mac 2016 update

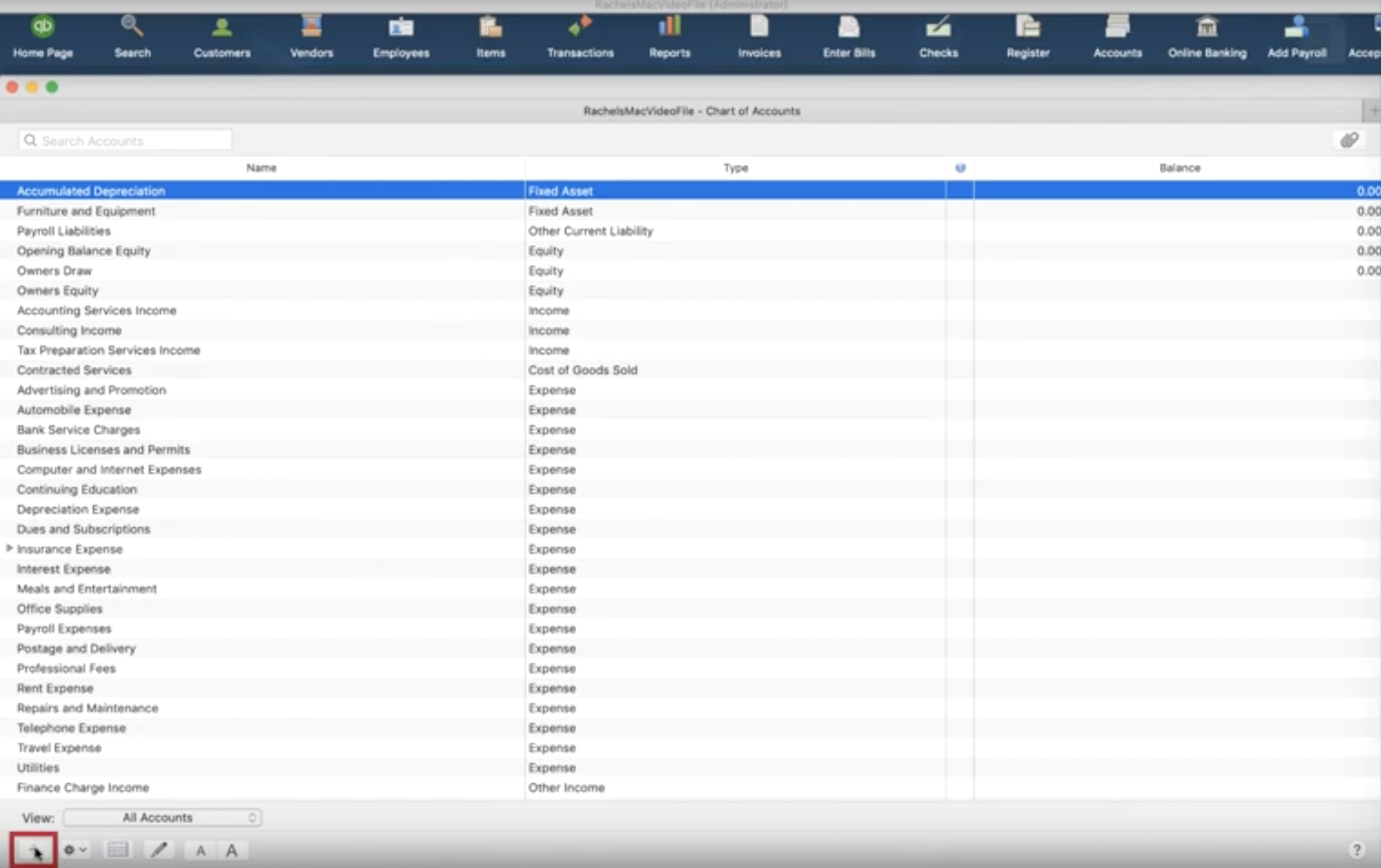

Finally, you’ll learn how to open a company file, update one to a new version of QuickBooks, and modify basic company information.įigure 1-1. Windows’ taskbar keeps your favorite icons near at hand. If you’re converting your records from another program, this chapter provides some hints for making the transition as smooth as possible. Then, if you need to create your company file yourself, you’ll learn how to use the QuickBooks Setup dialog box or the EasyStep Interview to get started (and find out which other chapters explain how to finish the job). This chapter begins by explaining how to launch your copy of QuickBooks. For example, if you’ve worked with an accountant to set up your company, she might provide you with a QuickBooks company file already configured for your business so you can hit the ground running. If you’re new to bookkeeping, another approach is to use a file that someone else created. You can create a company file from scratch or convert records that you previously kept in a different small-business accounting program, Quicken, or even another edition of QuickBooks like QuickBooks for Mac. A company file is where you store your company’s financial records in QuickBooks, so it’s the first thing you need to work on in the program.

0 kommentar(er)

0 kommentar(er)